Holderlab.io is a convenient web app for creating, analyzing, tracking and automating a cryptocurrency portfolio.

Most crypto applications cannot analyze the best crypto portfolios using the crypto correlation matrix. Most of them do not have the ability to test using the cryptocurrency backtesting platform.

How to track cryptocurrency portfolio?

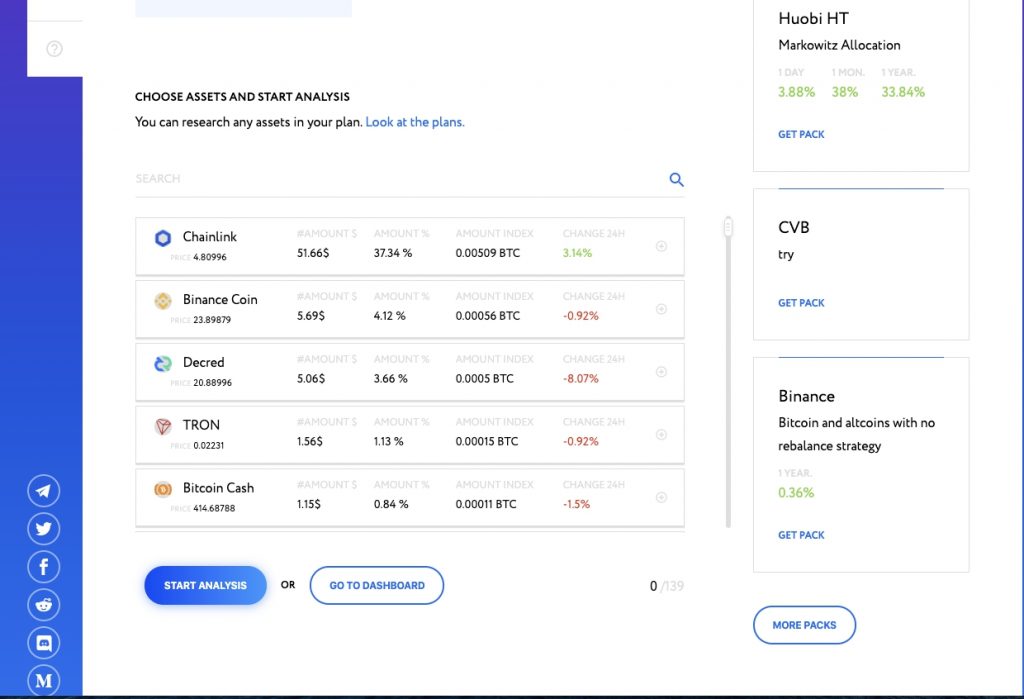

The application should be able to add an existing or create a new crypto portfolio.

The ability to choose among cryptocurrencies with high liquidity and their subsequent analysis.

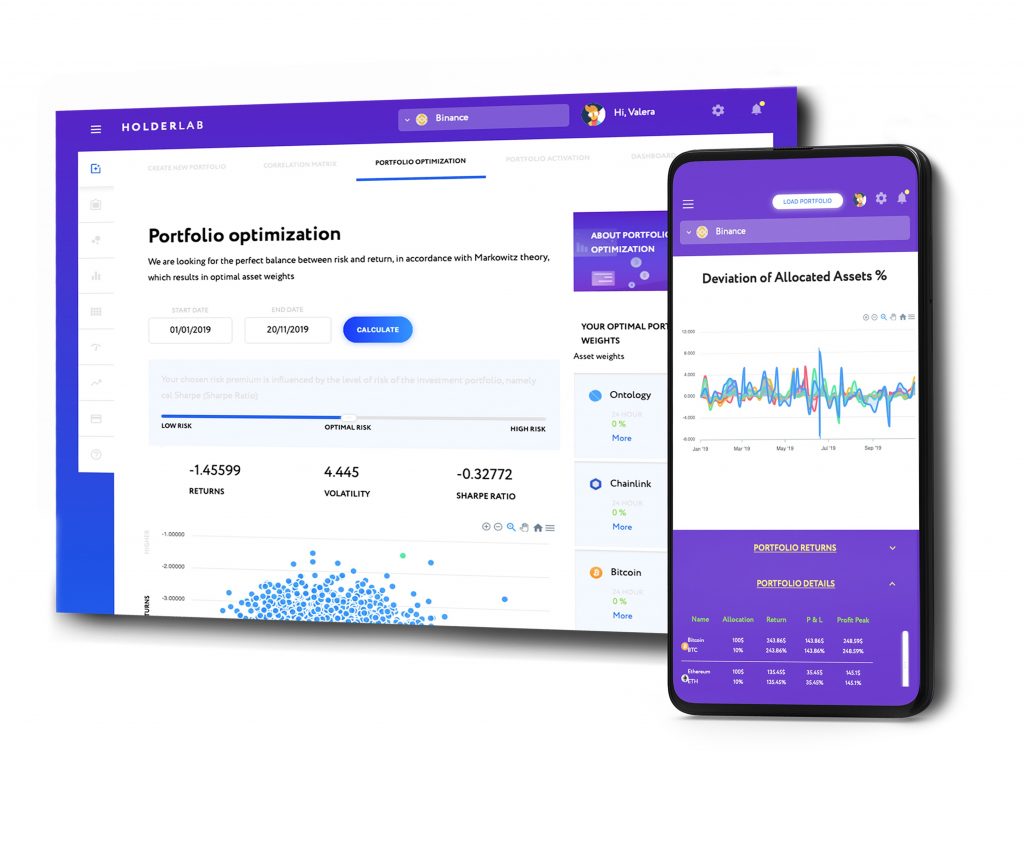

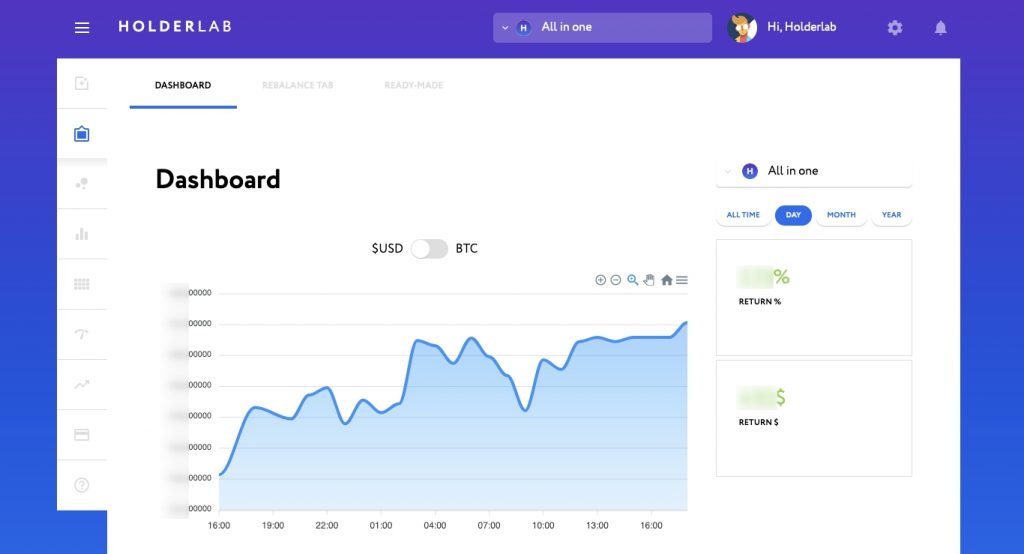

One of the convenient functions in the application is a single dashboard with all available statistics on crypto portfolios. This allows you to see the total historical profit and loss, the maximum drawdown. An application for a cryptocurrency portfolio should have the ability to switch statistical data. For example, between dollars and bitcoins.

A necessary function in the application is also the ability to switch between different timeframes that graphically show a graph of portfolio deviation depending on the selected interval.

The convenience of the service on mobile devices is a must for crypto investors.

How to analyze a cryptocurrencies?

The cryptocurrency market is highly volatile and not always investors can quickly analyze their investment portfolio.

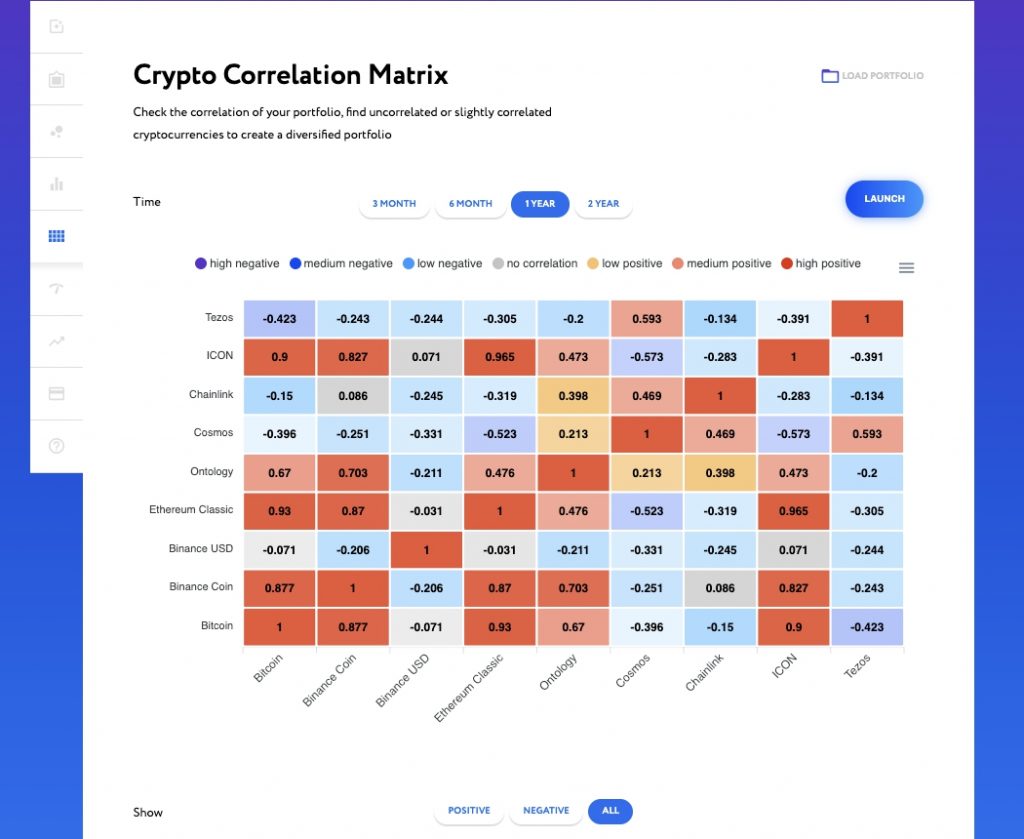

Holderlab offers analysis using the correlation matrix. Testing on historical data, as well as analyzing the distribution of assets using the Markowitz method.

Correlation analysis allows you to assess the degree of diversification of your portfolio. The correlation of cryptocurrencies is close to unity, then the portfolio is strongly correlated. With the nearest market correction, it can quickly sag, as digital assets move in one direction.

The ability to use the correlation analysis tool in a portfolio should be available on various timeframes. Include the possibility of considering both negative and positive correlations.

Crypto Portfolio Allocation

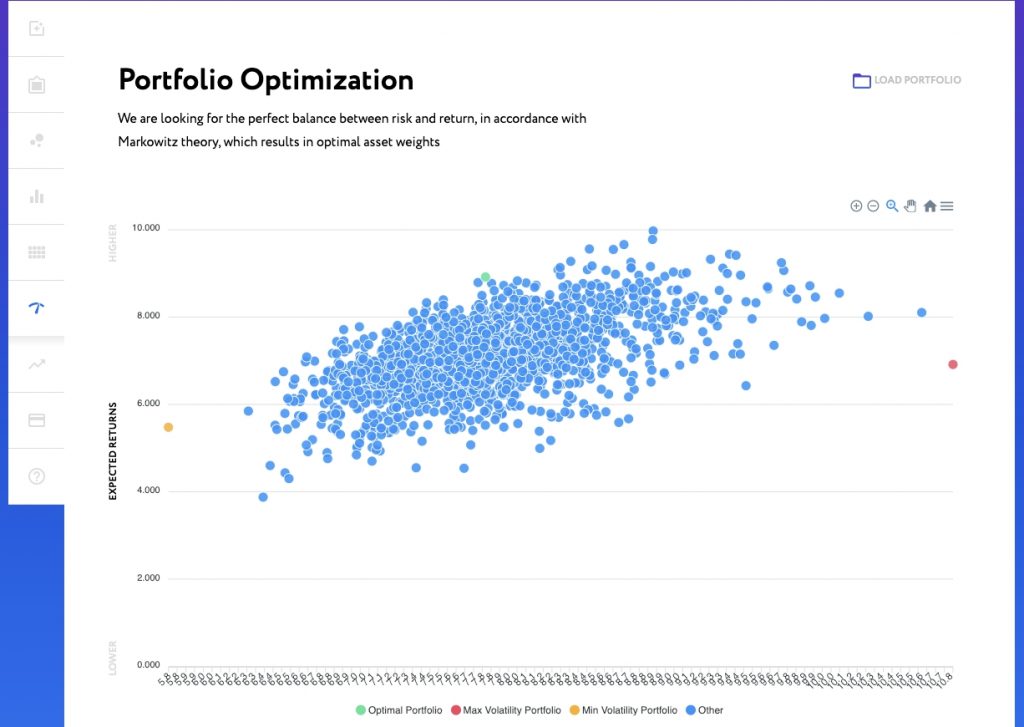

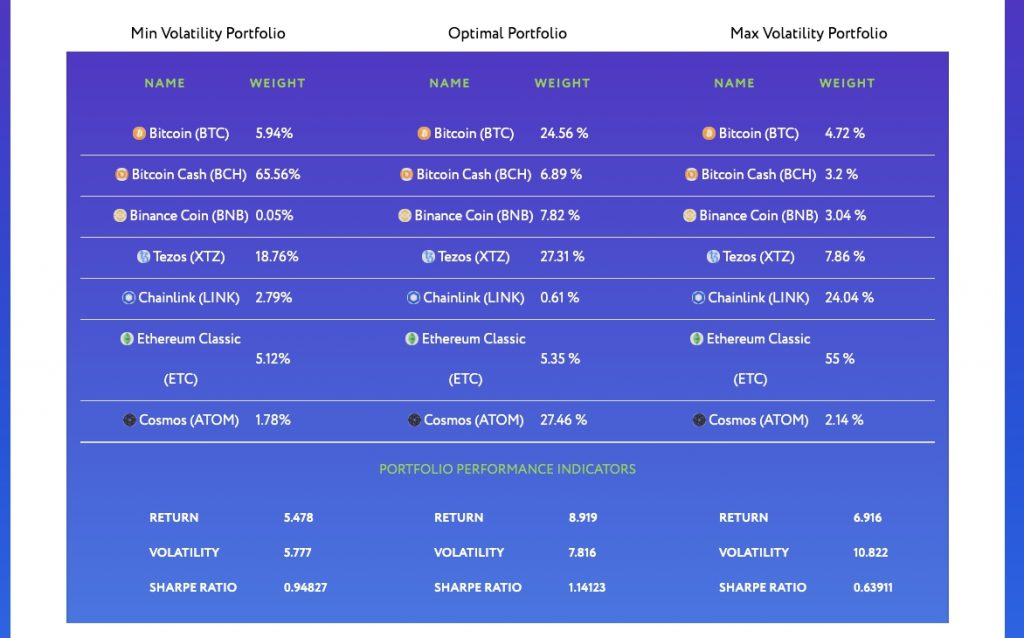

The digital asset allocation is an important condition in the subsequent analysis of effectiveness. Crypto investor can distribute the weight at his discretion. There are methods that allow you to distribute assets optimally based on the required return / risk ratio. One of the classical methods is the modern portfolio theory of Markowitz.

The result of such optimization is a graph of the efficient frontier on which an optimal portfolio exists.

And of course, cryptocurrency asset allocation in an optimal good cryptocurrency portfolio.

In conclusion, all of the above modules are necessary for creating, analyzing and tracking a crypto portfolio in the application.