Holderlab.io has one of the best cryptocurrency backtesting platform. If you want to test your portfolio, test rebalancing strategies in the historical period, you can use the history testing section. The history testing section is included in the subscription plan, starting from the Holder level, more about subscription plans here.

- Go to the backtest section, you can upload your portfolio using the “load portfolio” button or create / select a portfolio by selecting and adding cryptocurrencies.

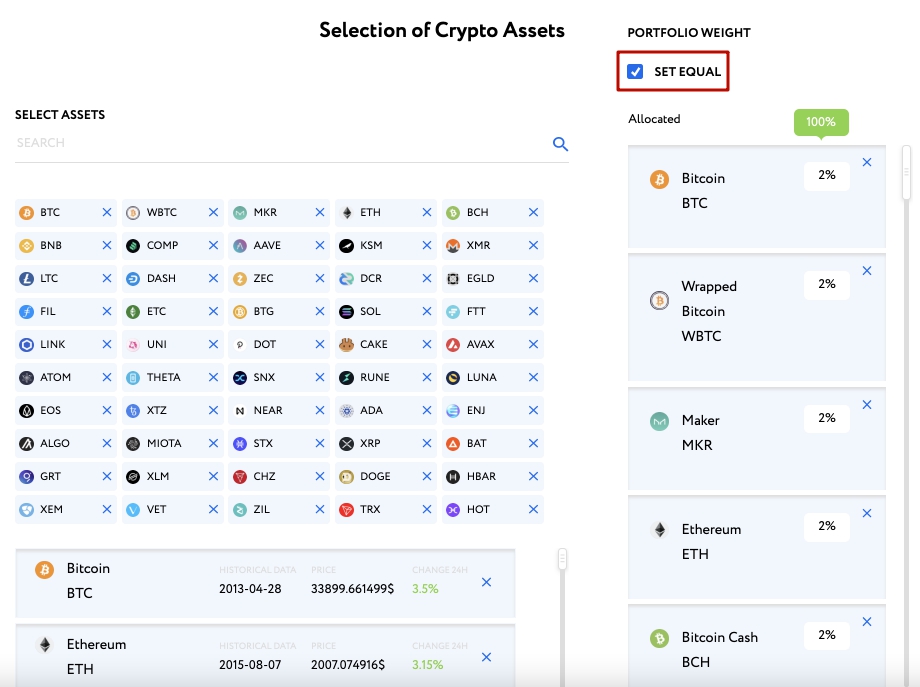

2. After you select the cryptocurrency portfolio of interest for testing, you need to put down the appropriate weight (distribution in%) for each cryptocurrency, the total amount of all cryptocurrency weights should be 100% if less or more backtest does not work. You can also add and remove cryptocurrencies using the “X” and “+” buttons. The following example is not an example for investment purposes, but an example to familiarize yourself with the platform.

Test your crypto strategy with cryptocurrency backtesting platform.

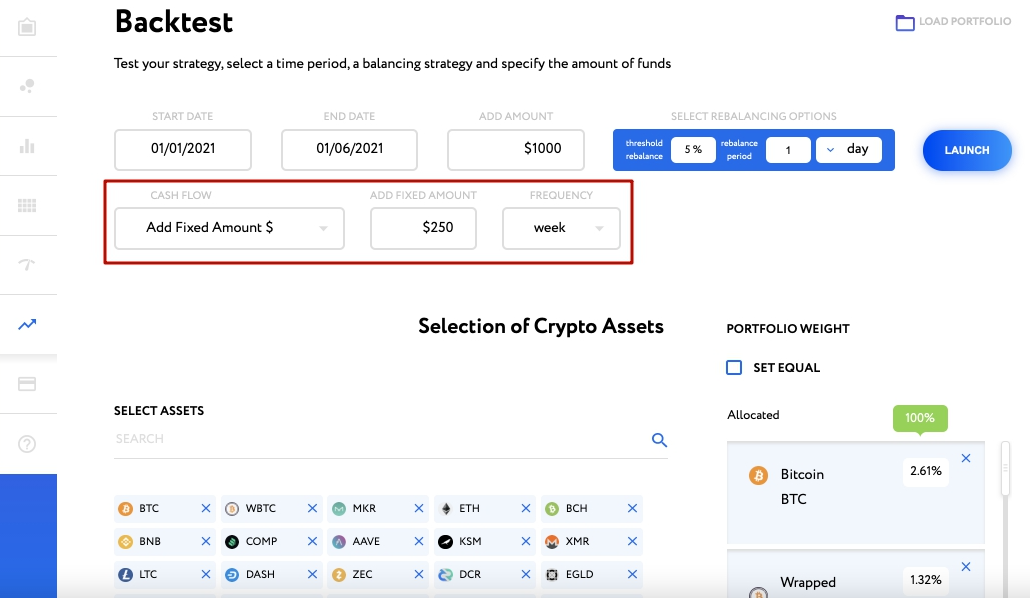

Next, you need to select a testing period, a rebalancing strategy and initial capital and click the “launch” button. Read more about the rebalancing strategy here.

4. After displaying the test results, you can analyze the graph in which the testing of the entire portfolio is represented – capitalization and each of the cryptocurrencies in the portfolio.

5. You can switch using the slider between $ USD and BTC, as well as turn off and switch coins on the portfolio chart. As well as increase or decrease periods on the chart and save the chart itself using the graphic toolbar located at the top – to the right above the chart.

Below is an example with graphical display of the portfolio in BTC and disabling on the chart “Capitalization” and “Bitcoin”

6. The following graph shows the deviation of allocated assets. In investing, the standard deviation of returns is used as a measure of volatility. The higher its value, the higher the risk associated with investing in this asset, and vice versa.

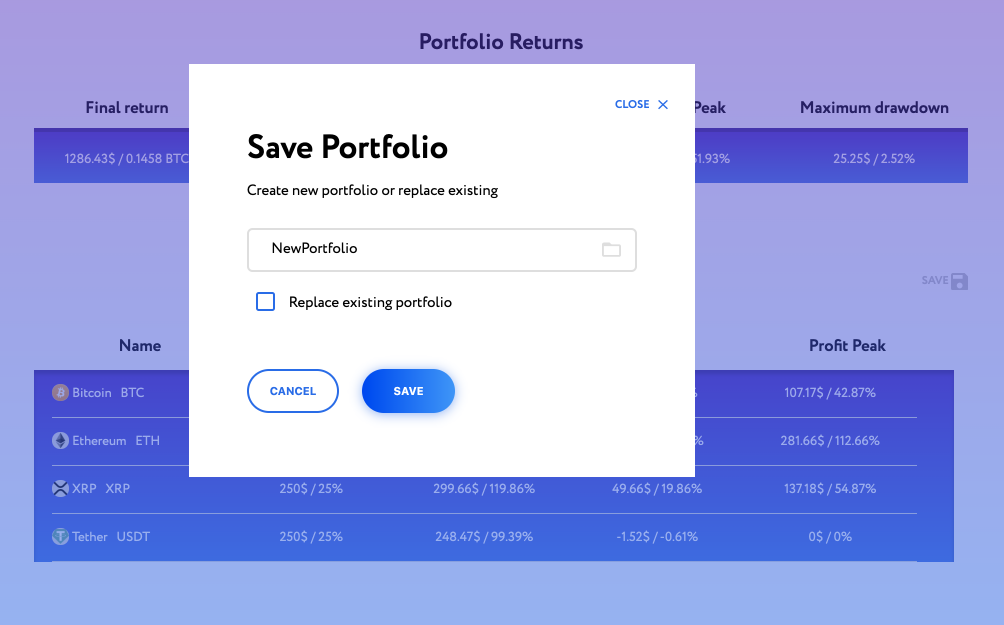

7. Finally, you get the total result of testing the crypto portfolio and a detailed assessment of cryptocurrencies by parameters.

Cryptocurrency portfolio return.

Final Return – characterizes the final result expressed in the sum of the starting test capital and the gain or loss depending on the result, expressed in “USD $” and “BTC”

Profit/Loss – shows the net gain or loss, expressed in “USD $” and “%” of the relative initial test deposit.

St.Deviation – measures the degree of portfolio risk. Portfolio correlation affects the standard deviation in a portfolio. Find out about the correlation of your portfolio here.

Profit Peak – shows the maximum peak of portfolio income.

Maximum drawdown – shows the maximum drawdown of the portfolio

Portfolio details, shows statistics for each asset in the portfolio, including:

Name – cryptocurrency name.

Allocation – distribution in USD $ and % depending on what you previously set.

Return – shows a detailed report on the return, taking into account the initial capital for each cryptocurrency in the portfolio.

P&L – shows the net deviation (profit or loss) excluding the initial capital for each cryptocurrency in the portfolio.

Profit Peak – shows the maximum income peak for each asset in the portfolio.

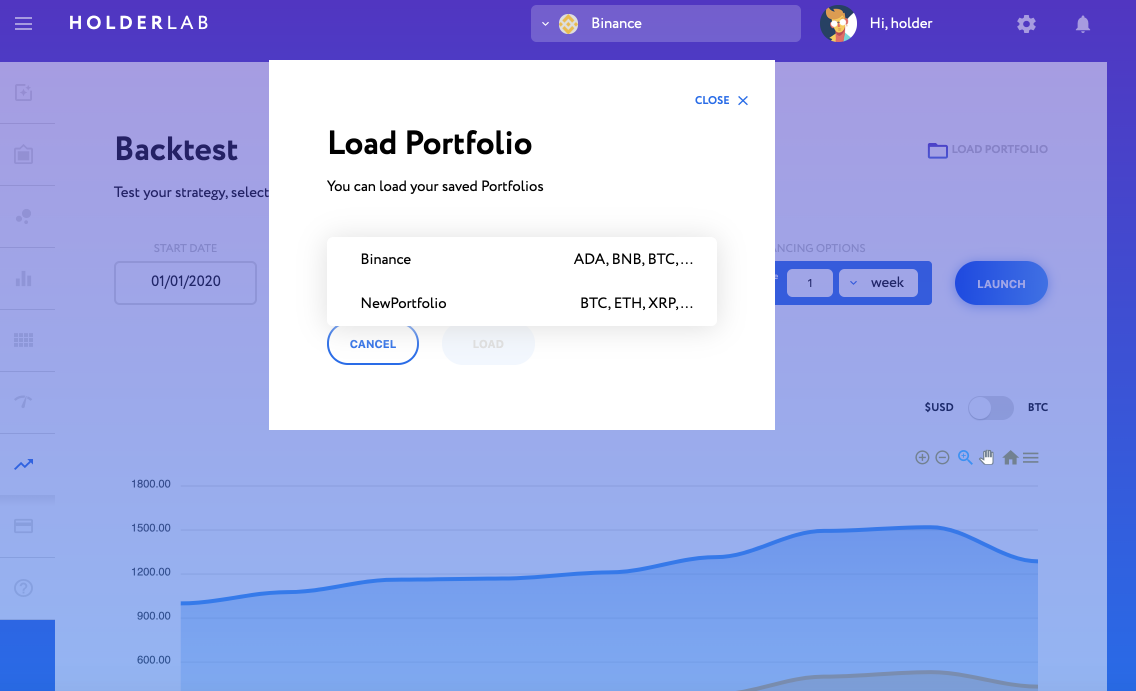

How to save and load portfolio in cryptocurrency backtesting platform?

By connecting a cryptocurrency exchange, you can save all your backtest portfolios.

Then you can load the portfolio by selecting them in the field.

You can load saved portfolios in Correlation Matrix or Portfolio Optimization tool.

Adding and withdrawing cash flow

Now you can add or withdraw your cash flow and see what impact it will have on the dynamics of your portfolio.

You can add a fixed cash flow, for example, once a day, week, or month. This way you will see how adding or withdrawing cash flow affects your portfolio.

Equal fraction setting function

For the convenience of users, we have added a function to evenly distribute shares in the portfolio. Now, when you choose a large array of cryptocurrencies, you do not need to manually set the required distribution in the portfolio. For this, we have added a distribution function of equal shares. Turning it on is easy enough. And your entire portfolio will be diversified for further analysis.